Guest blog: Private equity investment activity in the healthcare sector

)

This year’s Q2 private equity (PE) deal activity count has started to level off, after a significant drop in activity. This is particularly visible in platform/primary buyout types. In Europe (including the UK), the count for platform/primary buyout types has settled at 427, close to pre-pandemic levels. In the US, things have levelled out as well, sitting at 303 in Q2 compared to the 2019 quarterly average of 406, a 25% drop.

This levelling off, however, is not visible in acquisitions by PE-backed businesses (known as ‘add-ons’) in Europe (including the UK). Add-ons continue to remain under pressure and the deal count numbers continue downwards. Although the levels are still materially elevated from their pre-pandemic levels, sitting at 52% above 2019’s quarterly average for Europe (excluding the UK) and 28% for the UK. The US’s figure of 960 in Q2 is 9% up from 2019’s levels, and down 49% down from the peak of 2021 Q4.

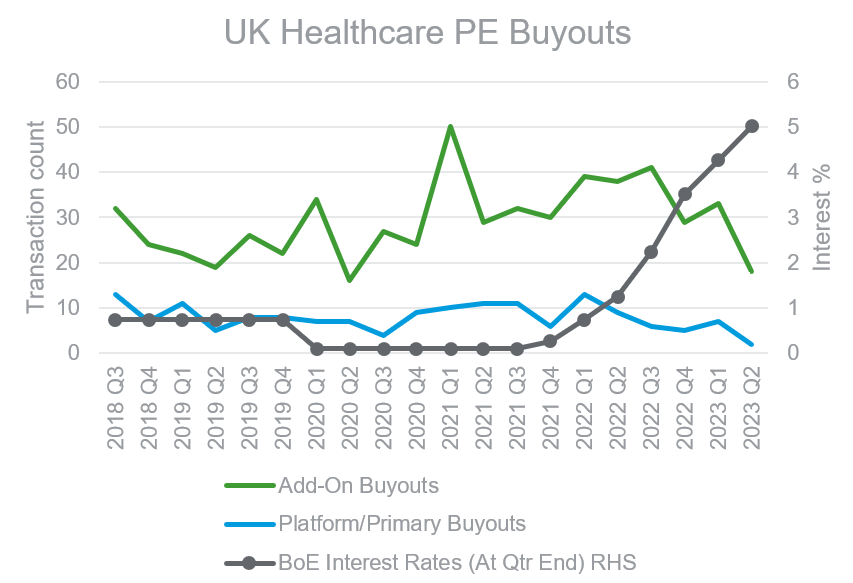

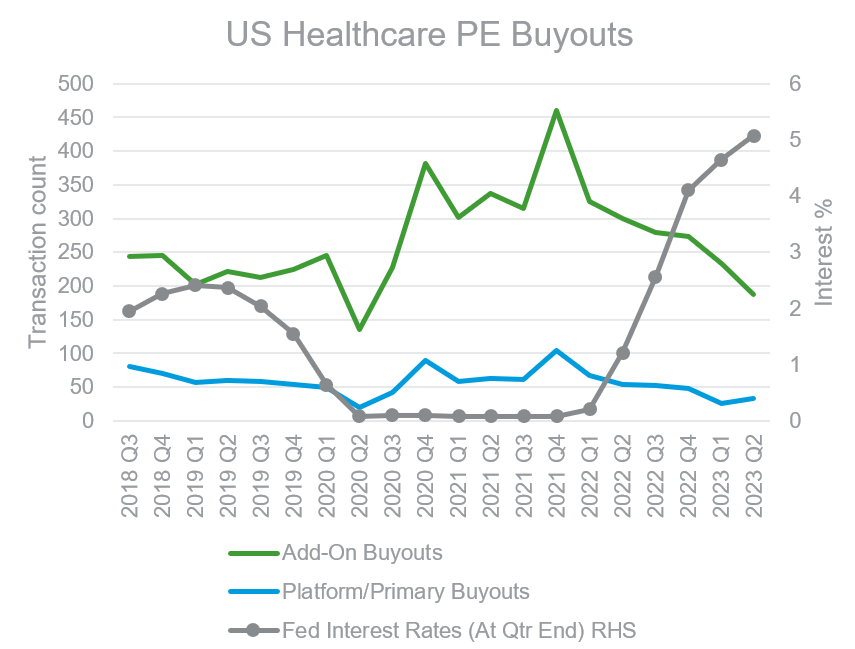

The healthcare sector has not been immune to the pressures, with PE-backed healthcare-related add-ons in the UK in H1 2023 down 53% compared to H1 2022 (from 55 transactions to 42 transactions). Platform deals were down 69% from 22 to 9. The US has performed similarly, with add-ons down 28% (504 to 362) and platforms down 52% (122 to 59). 2023 Q2 in particular has been hard hit, with total buyout count going below pre-pandemic levels for the first time.

Source: Data from PitchBook Data Inc, Bloomberg, RSM UK

A mix of headwinds impacting deal flow…

In April this year we looked at the negative impact of interest rates and the other economic headwinds on sellers’ willingness to sell, as well as on the viability for leveraged transactions and how this translated to pressures on different PE buyout types. We expect interest rates to stay ‘elevated’ (essentially back to the historical average).

Tighter monetary policy still needs to feed through to the economy, and the UK, along with the rest of Europe, will remain under pressure into 2024. As an illustration, Germany, which made up 14% of Europe’s buyout deal count in the first half of this year, has seen its IFO Business Confidence Index fall for three consecutive months, with July’s figure of 87 worse than economists expected and below the 10-year average of 96.

Fund raising will remain under pressure for the majority of PE firms as limited partners continue to rebalance their asset allocations. As a consequence, we are now starting to see some private equity investors holding back from deploying their capital – especially those with a high proportion already invested. They are doing this in order to avoid having to go into fund raising mode during this economic climate. Fund raising can be long and tough in the best of times, and brutal when the markets are down.

…with a mix of tailwinds too

New funds are still being raised, but this is being increasingly concentrated into the hands of larger funds that typically have better known track records. For example, CVCs announced in July this year that they had raised a European record of €26bn for their latest fund. As PitchBook Data Inc described the concentration: “megafunds get more mega."

We are seeing active interest in the most attractive assets, and pressure remains on PE investors on the whole to deploy their ‘dry powder’ which still remains at near record levels. For example, IK Partners’ acquisition of listed teleradiotherapy solutions provider Medica Group PLC (announced in May 2023) saw a premium of 41% offered to the average share price of the preceding 12 months. That valued the business at £269m with IK’s investment to be used to develop the company’s technology, people and capabilities, both organically and through M&A.

The UK NHS’s inability to meet demand continues to form the basis of investment cases in healthcare, especially in services. And that demand will be supported over the longer term by the ageing population. Further, irrespective of the elected party in the UK general election in 2024, we expect healthcare to remain a high priority with solutions sought to meet that demand.

The general election may lead to the introduction of a capital gains tax, which would spur owner-managed businesses into a sale. We are unlikely to see the spike in deal activity like in 2021 Q1 as that was supported by post pandemic optimism and ultra-low interest rate, but it could lead to an uplift nonetheless.

Also, the easing of inflation in key countries like the UK, Germany and the US and our expectation that interest rates will not need to rise much further is helping provide certainty for projections – a key ingredient for the confidence in decisions made by sellers and buyers.

Overall, considering the mix of headwinds and tailwinds impacting investors, deal count in the healthcare space is likely to remain approximately at Q2’s levels for the rest of 2023, and possibly into 2024, with add-on acquisitions remaining the predominant transaction type.

How can RSM help?

For further information, please contact Jasper van Heesch, private equity senior analyst.

To discuss finance options for your healthcare business, please contact Suneel Gupta, head of private healthcare.